Grow ARR in a challenging economy: Avoiding the budget reduction landmine

A lot of things are going in the wrong direction—but your revenue doesn’t have to.

Soaring inflation, rising interest rates, low growth, the constant spectre of recession—suffice to say, it’s arguably the worst time for consumers and businesses since the 2008 financial crisis.

The double whammy of Covid-19 followed by the war in Ukraine has led to unprecedented pressure on global supply chains and commodity prices, and this is significantly impacting the prices consumers and businesses are paying for goods and services. The unpredictability of these macro issues are leading to delays in investments, with greater scrutiny of purchasing decisions.

The SaaS sector is feeling significant pressure, and across the industry this is manifesting in reduced sales, pressure to reduce cost and a need to maintain existing client relationships. Meanwhile, some of the biggest players in the industry have had to make significant layoffs.

According to Layoffs.fyi, at the time of writing almost 800 separate companies have laid off over 210,000 employees. This includes approximately 12,000 at Google, 10,000 at Meta and 10,000 at Microsoft.

Many of our clients in this sector are feeling their own versions of this pressure—no doubt your organisation is feeling the strain too.

In this article we’re going to take a look at what SaaS leaders are saying about the current situation, the big issues you’re probably facing and, most importantly, how you can deal with them.

Want the highlights? Download the report's executive summary.

The view from the top - what SaaS leaders are saying

The threats in the current economy can’t be denied, but when Salesforce President & CMO Sarah Franklin, Box CMO Chris Koehler, and Attentive CMO (and ex-Twilio CMO) Sara Varni came together for Mutiny’s The Second Lever conference, the message was clear: this is an opportunity for SaaS vendors.

Inevitably, your potential customers are anxious about inflation, supply chain disruption and labour shortages, but SaaS can actually help businesses meet these challenges.

"The three CMOs were also unanimous in the response to whether now was the time to cut marketing budgets—100% no."

“The good thing about SaaS businesses is that technology is the solution our customers are seeing as the way that they’re going to automate themselves, get more productivity, more efficiency, and just help businesses run better,” said Franklin.

Chris Koehler agreed that difficult economic conditions don’t mean that the pain points your software can solve are going away: “It doesn’t matter if you’re an SMB…or a large enterprise: You’re trying to figure out, ‘How do I create a better customer experience? How do I engage my customers? And quite frankly, how do I make my employees collaborate in a world that is very hybrid?’”

The three CMOs were also unanimous in the response to whether now was the time to cut marketing budgets—100% no.

“Let’s not talk about how we cut; let’s talk about how we can be more efficient…Cutting marketing is very short-term thinking, and that’s what’s going to cut your future growth,” said Franklin.

SaaStr founder and host Jason Lemkin agreed: “When you cut marketing you cut the medium term. You’re cutting off your pipeline in one, or maybe even two years.”

This isn’t to say you shouldn’t be making sure you’re spending your marketing budget more wisely.

At SaaStr 2022, 6sense CMO Latané Conant explained her approach to ensuring marketing campaigns are performing: follow the red.

“Whenever I see an underperforming metric in my marketing dashboard, I proactively investigate to see what needs to be done to turn it green.”

These SaaS marketing leaders might be preparing to double down on their marketing in the wake of the current economic crisis, but are they in the minority?

Many SaaS organisations will take the opposite view to the CMOs we’ve looked at here and, while exercising prudence during tough times is always wise, there are some common mistakes businesses make that will only make things worse…

6 issues SaaS leaders are facing… and how you can tackle them

Issue #1: Marketing budgets under pressure

During challenging times, marketing is often one of the first departments to be scaled back. Many organisations view marketing as a luxury and instead prioritise core operational expenses they deem essential to keeping the business running.

There’s also the argument that, if consumers and businesses are investing less money anyway, marketing to your prospects at the same level as during good times is a waste of money.

It’s a common reaction, but research suggests that doing so hurts organisations in the medium term.

A study conducted by McGraw-Hill Research (now part of S&P Global Market Intelligence) in 1986 found that ‘firms that maintained or increased advertising during the 1980-81 recession averaged significantly higher sales growth during the recession and for the following three years than those which eliminated or decreased advertising.’

Note the reference there to ‘the following three years’. Increasing marketing spend during an economic downturn might not lead to immediate results, but you’re laying the foundations for success when the recovery begins.

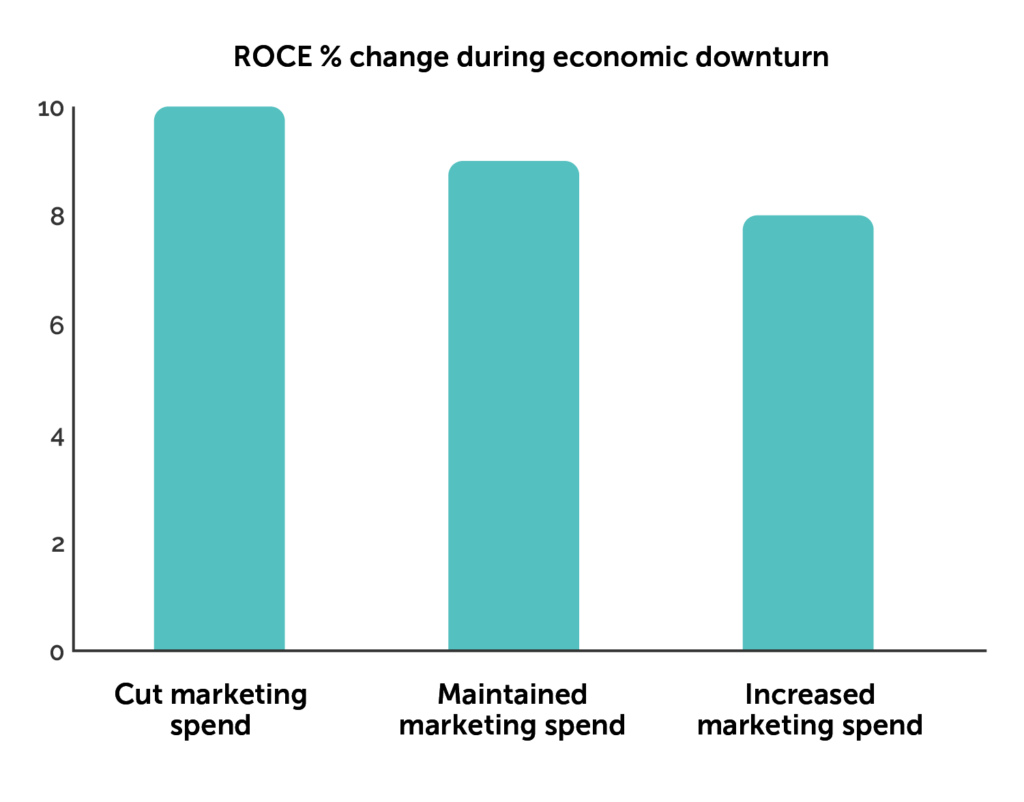

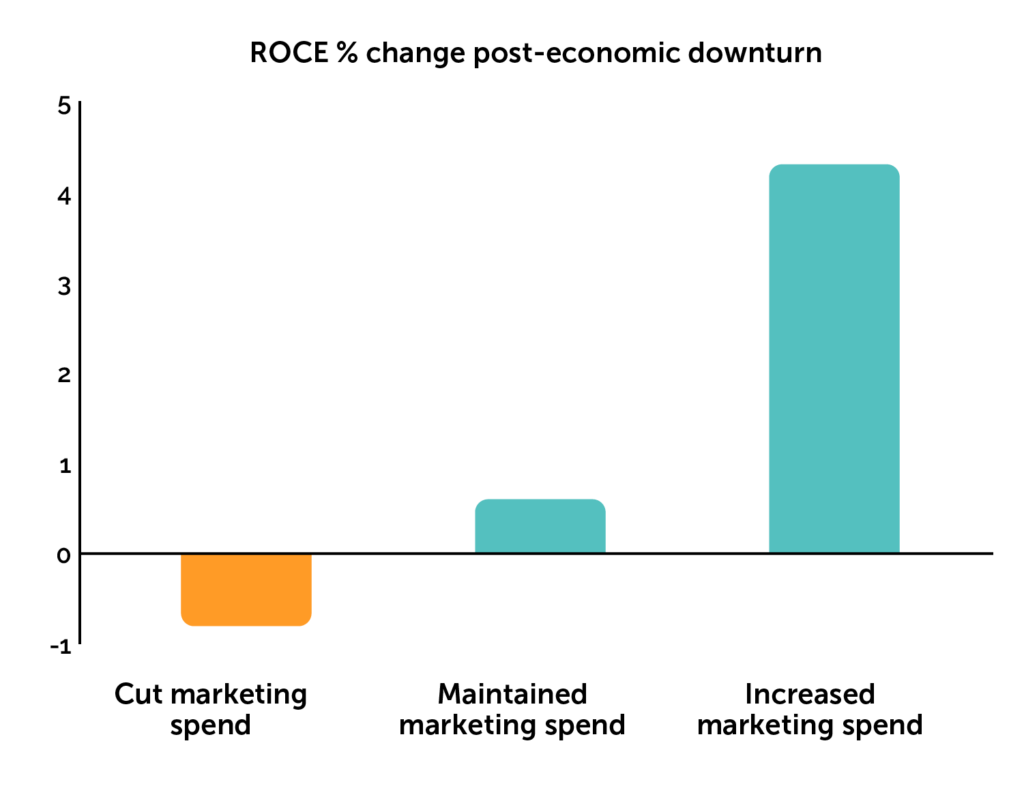

In the wake of the 2008 financial crisis, Peter Steidl highlighted data which supports this from the Profit Impact of Marketing Strategies (PIMS) in his book ‘Survive, Exploit, Disrupt: Action Guidelines for Marketing in a Recession’.

The PIMS database showed that return on capital employed (ROCE) increased by 8% for companies that increased marketing spend, by 9% for companies that maintained spending, and 10% for companies that cut spending. Fine margins, but that would suggest you should cut your marketing spend, right?

However, when you look at the difference in performance once the recovery begins, it’s clear who comes out on top. In the first two years following a recession, ROCE increased by 4.3% for organisations that increased spend, compared to just 0.6% for companies that maintained spending, and a drop of 0.8% for companies that cut spending.

There’s a great example from recent history that demonstrates this dynamic.

In the wake of Covid, the travel industry was among the biggest losers. National lockdowns and travel restrictions were in place throughout 2020 and 2021, but Airbnb and VRBO responded very differently.

Airbnb slashed their ad spend during this time, but VRBO stepped it up. Between January and February 2021, VRBO spent $90.8million in advertising, while Airbnb spent just $8.9million.

The result?

VRBO’s bookings recovered by 61%, compared to a 15% drop for Airbnb in the same period.

“Be fearful when others are greedy, and greedy when others are fearful.”

— Warren Buffet

How to tackle it: Don’t talk about how you can cut, talk about how you can be more efficient

You don’t necessarily have to take VRBO’s approach and increase marketing spend, but the mistake is thinking in terms of cuts rather than efficiency.

You need to get forensic in looking at your current marketing and identifying what’s working, what’s underperforming and what’s flat-out failed. Shift budget towards ad campaigns that deliver the highest ROI, be more discerning in the events you sponsor and scrutinise every penny spent—but don’t just implement a blanket cut in your marketing budget. Pulling money from marketing and taking decisions that aren’t backed by data is just as likely to cost the organisation money as save it.

Issue #2: Neglecting the decision makers

If you’re selling to a B2B market, who’s the person you need to convince to invest? Is it the employee(s) who will be using your software every day, or the CXO controlling the purse strings?

Of course, there will be multiple stakeholders in a B2B sales process, but the final decision maker is typically at board level. That’s not a profound statement, but then why do so many SaaS vendors prioritise the user buyer in their marketing messaging?

You talk about specific features and why your software is easier to use than your competitors’ products.

Valuable points to make, but the economic buyer doesn’t care about that fancy widget that no other software offers. They care about how your product is going to impact the top or bottom line.

How to tackle it: create messaging for both user and economic buyers

In B2B SaaS sales cycles the user buyer is often the person conducting the initial research. They’ll also be the first person to make an enquiry, so it’s essential you have compelling marketing messages ready for them.

However, the further you get into the sales process, the more economic buyers will get involved. Once in the room with CXOs, you can’t just deliver the same messaging as with user buyers.

These two groups have unique challenges and you need to be able to show your solution delivers for everyone’s needs.

How to sell to user buyers

In many ways, user buyers are your reason for being. Making their day-to-day job easier is what your product is designed to do, and this is how they’re going to judge your solution.

This means they want to evaluate user experience and operational impact. Testimonials and reviews from satisfied users are great here, but the best way for them to do so is through hands-on experience of the software via demonstrations and free trials.

How to sell to economic buyers

If you’ve got a list of target accounts you can either start by trying to get in front of user buyers, or go straight to the decision makers. This is harder, but can be a faster route to sale.

Lots of organisations are trying to secure meetings with the same economic buyers you are, and they’re getting reached out to a lot. This means you need to give them a very good reason to take a call or book a meeting with you.

Generic elevator pitches won’t cut it. Make sure you’ve got some quantifiable benefits you can offer straight out of the gate to grab their attention.

For the sales pitch itself, remember that economic buyers aren’t solutions experts like the user buyers you’re trying to sell to, and they don’t have the time to be. In the majority of cases, they simply want to understand the potential return on investment.

During sales pitches, economic buyers love to see case studies and examples of where you’ve helped businesses like theirs increase revenue and reduce costs.

It helps to get straight to the point with economic buyers too, so avoid padding your presentations with information that’s not going to interest them, such as company history and culture. The specifics of your SaaS solution are important for user buyers, but economic buyers don’t need to understand how the platform can be used day-to-day, so communicate this with user buyers when the economic buyers aren’t in the room.

Put together an org chart

Every stakeholder needs to be considered and engaged with for a B2B SaaS sales pitch to go smoothly. We’ve talked about both economic and user buyers, but there are key differences within these groups you need to have visibility of.

A detailed org chart will map out everyone within the business and what you need to do to get them onboard: what pains are they experiencing, what are they trying to achieve, what objections might they have to your solution?

This will take some time to research, and you might need to get the support of your Champion within the organisation to make sure it’s accurate, but it’ll be worth the time investment.

Issue #3: Pressure to prioritise the bottom of the funnel

When generating new revenue becomes more of a concern, SaaS vendors often focus more of their efforts on the bottom of the funnel. This isn’t a mistake. In fact, we recommend to the SaaS companies we work with to start at the bottom and work backwards, prioritising tactics that will deliver the fastest ROI.

The issue is when you only focus on the bottom of the funnel. Afterall, 96% of visitors that come to your website are not ready to buy.

Sales teams abandon value-led comms in favour of outbound efforts with cold calls and emails. Marketing stops creating awareness-level content and instead focuses on pushing features and benefits of their software.

It's not a mistake to focus more of your efforts on the bottom of the funnel. The issue is when you only focus on the bottom of the funnel.

There are two problems with this strategy.

Firstly, outbound sales can work for you, but it’s hard. Developments in tech and automation have simplified the process in recent years, but response rates have reduced dramatically. Tools, people and economic state make this an expensive—and not always predictable—channel to facilitate growth.

Secondly, neglecting the top and middle of the funnel will see your pipeline dry up in the medium to long term. Event sponsorships, gated content and brand awareness efforts won’t necessarily drive sales today, but they do drive the leads that will become new customers tomorrow.

Further to the above statistic highlighted by the Adobe eBook on lead generation, a 2022 study published by LinkedIn’s B2B Institute and the University of South Australia’s Ehrenberg-Bass Institute for Marketing Science found that just 5% of a business’ total addressable market has intent to buy. Further to this, research by Gartner revealed that 83% of a lead’s journey is not spent with a sales rep. The final 17% is where a lead is closed and becomes a customer, but they’ll never get there without being nurtured throughout the funnel.

83% of a lead’s journey is not spent with a sales rep:

That 5% might be where the money can be found today, but neglecting the remaining 95% is going to cost you opportunities in the future.

How to tackle it: implement a multi-channel marketing strategy

If growing revenue quickly is a priority, putting more resources into the bottom of the funnel isn’t a mistake, but it could be if it’s at the expense of all your other channels.

Make sure you continue with a multi-channel marketing strategy. That means keep posting on your social media channels. Continue creating educational content that helps your prospects understand the solutions to their challenges.

Sales’ time will be much better spent reaching out to warmer leads, and it will also help to ensure your pipeline is healthier in 6-12 months. Additionally, utilising both brand building and performance elements in a campaign often increases overall return on ad spend compared with spending on performance channels alone.

Two great examples that demonstrate the impact of brand building - specifically content marketing - are Lumen5 and Moosend.

Lumen5, a dedicated social media marketing tool, went from 25,000 website visits to over 500,000 in less than a year thanks to content marketing—but they also created multiple content offers that captured leads who were at different stages of their buyer’s journey.

For Moosend, a marketing platform specialising in email marketing, a full funnel marketing strategy increased their organic traffic by 10X, while they’ve also created a number of gated resources for converting that traffic into leads, including webinars and infographics.

Issue #4: It’s hard to stand out in a crowded SaaS market

You’ve identified your user’s pain points and solved them with an effective SaaS solution. Your pricing is competitive and the UI is slick.

But guess what? You’re not necessarily as special as you think you are.

Back in 2012, the average number of competitors for SaaS firms was three. By 2017 this increased to nine, and the SaaS market is still growing rapidly. The global SaaS market is expected to hit $720.44billion by 2028.

Your solution might be the best around, but don’t overestimate your USPs and expect them to speak for themselves.

This isn’t just about the specific features of the software. For example:

- Your solution might have the most comprehensive functionality, but if your onboarding and knowledge base is poor people won’t be able to use it.

- You might be the lowest cost solution on the market, but you don’t offer a free trial.

How to tackle it: effectively differentiate yourselves from the competition

In order to ensure your SaaS product stands out from the crowd, you need to understand what the crowd is offering.

Conduct thorough competitor analysis to identify their strengths and weaknesses, and user research to discover what your prospective customers actually want from a SaaS product.

From this research you should develop (or refine) your ideal customer profiles (ICP) and buyer personas.

Note that these aren’t the same thing.

ICPs are only relevant to B2B SaaS vendors, and describe what your perfect customer looks like—a fictitious company that boasts all of the qualities you’d want from a customer that’s the best possible fit for your products or services.

Help me define my ideal customer profiles

By contrast, buyer personas are a semi-fictional representation of the people that buy from you. For B2B SaaS sales, they refer to the decision makers involved in the sales cycle, including both user and economic buyers.

Help me define my buyer personas

Having a clear understanding of what motivates your customers will help define your marketing efforts, as well as how your product and processes can be optimised.

If you’re best-in-class in one aspect of your solution make sure you’re emphasising that during sales meetings. If you’re lagging behind in another, put more effort into improving that aspect of your offering.

In a crowded SaaS market differentiation is essential, and this requires an organisation-wide effort to understand and communicate where the value in your solution lies.

Also remember that businesses and consumers make decisions based on subjective criteria too, so it’s not enough to simply push software features and neglect to consider how your marketing and sales strategy makes your target audience feel.

There’s also a connection here as to why cutting marketing budgets is a mistake. Reducing your presence in the market will give your competitors an advantage in the fight for your target market’s attention, and it might be hard to recover when the economy improves.

Once you’ve clearly identified the needs and challenges of your target market, and how you stack up against the competition, you need to nail your value proposition to ensure you’re standing out in your market and speaking directly to your personas. Again, this requires input from multiple teams—not just marketing. Sales, account managers and customer success reps will all have valuable input here in helping marketing to craft messaging that answers the target market’s pain points, having engaged with them throughout different stages of the user journey.

Issue #5: Pressure to focus on new leads/sales at the expense of existing users

We get it.

Growth is slowing down, the economic forecasts aren’t looking good and you’re worried about hitting your revenue targets. It’s time to focus all our efforts on generating new leads and closing new customers, right?

This isn’t just a common mistake that SaaS organisations make—it’s a mistake businesses across sectors make.

Yes, generating new business is crucial to growth, but it’s your current users who are the foundation of your annual recurring revenue (ARR).

If the organisation neglects existing users you’re going to see an increase in churn and find it even harder to meet those growth goals.

Current users who are the foundation of your annual recurring revenue (ARR).

Kevin Stoll, Vice President of Capgemini told SaaStock: “You still see large organisations overspending in areas that aren’t related to retention of customers.

“They still have too many focuses: they’re trying to break into multiple geos and launch new products.”

But what might this ‘neglect’ look like?

- Cutting the Customer Success and Service teams and trying to manage existing users with less resources.

- Focusing all of your marketing efforts on new business and not sharing product updates, special offers and educational content with existing customers.

- Focusing all of your sales efforts on new business and missing out on upsell and cross-sell opportunities from existing customers.

How to tackle it: Work closely with Customer Success teams to ensure you’re driving retention and long term usage

New business will (almost) always generate greater net new revenue, but you’re not going to grow MRR and ARR without a satisfied existing customer base, and there are three key reasons for this:

Increased customer churn

A 2022 survey of 110 private SaaS companies found that the median gross dollar churn for the sector is 14%.

The more you shift your focus from existing users to new business, that 14% is only going to increase, but you’ll also see an increase in involuntary churn: the result of expired credit cards, technical issues etc. It’s estimated that as much as 40% of churn could be caused by losing customers who don’t even want to leave.

Fewer positive reviews and referrals

One of your most powerful sales tools are existing users.

G2’s 2021 Software Buyer Behavior Report found that ‘86% of software buyers, across segments, use peer review sites when buying software’, which means your potential new customers will be deterred by negative reviews—or a lack of positive ones.

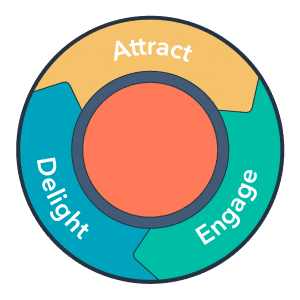

This is the rationale behind HubSpot’s Flywheel model.

It explains the momentum gained when the entire organisation is aligned around delivering an exceptional customer experience.

Existing customers are also a new revenue opportunity

As mentioned above, a new customer will probably always offer a larger net new revenue opportunity—but upsells and cross-sells from existing (and, most importantly, satisfied) customers might be easier to close.

“The cost of acquisition is quite a bit lower. You already know their preferences and what they do, and they know how they use your product,” said Kevin Stoll.

They already know your product, hopefully understand its value, and will be more open to investing more money than someone who’s never used the software before.

Issue #6: It’s hard to find the right marketing partner

The vast majority of organisations—from B2B to B2C, from SaaS to ecommerce—use similar strategies and market themselves across the same platforms. So, as long as you’re working with marketing experts, you’re in safe hands, right?

Not really.

A marketer or marketing agency who doesn't specialise in a particular niche (such as SaaS) might be an expert in Google Ads, SEO, copywriting or social media, but they don’t necessarily know your market, understand a SaaS sales cycle or the KPIs that matter most to you.

How to tackle it: work with SaaS marketing experts

If you’re looking to make an internal hire or employ the services of an agency or freelancer, make sure they have experience in the SaaS market. If it’s the latter, ask for case studies and testimonials from SaaS organisations they’ve worked with.

Not every agency will be able to back up their claims with examples that demonstrate genuine results. Some can...